药明康德联席首席执行官胡正国先生表示:“2019年前三季度,公司总体收入和经调整Non-IFRS净利润保持了加速增长的趋势。一方面,公司持续拓展新客户并提高原有客户的渗透率;另一方面,公司加强上下游服务部门之间的转化,平台协同性进一步增强。报告期内,公司新增客户超过900家、活跃客户超过3,700家,各项业务均保持稳健发展。”

胡正国先生补充道:“前三季度,公司里程碑和销售分成的收费模式项目,助力客户完成16个研究性新药的临床试验申报,并获得20个项目的临床试验许可;截至2019年9月30日,公司累计为中国客户完成71个研究性新药的临床试验申报,并获得54个项目的临床试验许可。截至2019年9月30日,公司小分子CDMO/CMO服务项目所涉新药物分子超过900个,其中,处于III期临床试验阶段的项目40个、已获批上市的项目17个;公司细胞和基因治疗CDMO平台为24个I期临床试验项目以及9个II/III期临床试验项目提供服务。2019年9月,公司完成了3亿美元零息可转换债券发行,将有效支持公司业务拓展,以及外延并购战略。”

药明康德董事长兼首席执行官李革博士总结道:“在业务保持加速发展的同时,公司持续建能力,扩规模,进一步完善赋能平台建设。这些投入将有助于保持和增强公司的核心竞争力,为未来的发展奠定坚实的基础。药明康德将坚定不移地为全球客户赋能,助力他们推动更多新药、好药早日问世,早日实现‘让天下没有难做的药,难治的病’的伟大愿景,造福病患。”

关于药明康德

药明康德(股票代码:603259.SH/2359.HK)为全球生物医药行业提供全方位、一体化的新药研发和生产服务。通过赋能全球制药、生物科技和医疗器械公司,药明康德致力于推动新药研发进程,为患者带来突破性的诊疗方案。本着以研究为首任,以客户为中心的宗旨,药明康德通过高性价比和高效的研发服务,助力客户提升研发效率,服务范围涵盖化学药研发和生产、细胞及基因疗法研发生产、医疗器械测试等领域。目前,药明康德的赋能平台正承载着来自全球30多个国家的3,700多家合作伙伴的研发创新项目,致力于将更多新药、好药带给全球病患,早日实现“让天下没有难做的药,难治的病”的愿景。更多信息,请访问公司网站:

前瞻性陈述

本新闻稿有若干前瞻性陈述,该等前瞻性陈述并非历史事实,乃基于本公司的信念、管理层所作出的假设以及现时所掌握的资料而对未来事件做出的预测。尽管本公司相信所做的预测合理,但是基于未来事件固有的不确定性,前瞻性陈述最终或变得不正确。前瞻性陈述受到以下相关风险的影响,其中包括本公司所提供的服务的有效竞争力、能够符合扩展服务的时间表、保障客户知识产权的能力、中美贸易摩擦影响等。本新闻稿所载的前瞻性陈述中仅以截至有关陈述做出当日为准,除法律有所规定外,本公司概不承担义务对该等前瞻性陈述更新。因此,阁下应注意,依赖任何前瞻性陈述涉及已知及未知的风险。本新闻稿载有的所有前瞻性陈述需参照本部分所列的提示声明。

Non-IFRS和经调整Non-IFRS财务计量

为补充本公司按照国际财务报告准则呈列的简明综合财务报表,本公司提供Non-IFRS归属于上市公司股东的净利润(不包括股权激励计划开支、上市及可转股债券发行相关费用、汇兑波动相关损益、并购所得无形资产摊销)、经调整Non-IFRS归属于上市公司股东的净利润(进一步剔除已实现及未实现权益类投资收益、应占合营公司盈亏)、经调整Non-IFRS每股收益作为额外的财务指标。这些指标并非国际财务报告准则所规定或根据国际财务报告准则编制。本公司认为经调整之财务指标有助了解及评估业务表现及经营趋势,并有利于管理层及投资者透过参考此等经调整之财务指标评估本公司的财务表现,消除本公司并不认为对本公司业务表现具指示性的若干不寻常或非经常性项目。该等非国际财务报告准则的财务指标并不意味着可以仅考虑非公认准则的财务指标,或认为其可替代遵照国际财务报告准则编制及表达的财务信息。阁下不应独立看待以上经调整的财务指标,或将其视为替代按照国际财务报告准则所准备的业绩结果,或将其视为可与其他公司报告或预测的业绩相比。

1. 经调整净利润:经调整Non-IFRS归属于上市公司股东的净利润。

2. 在中国企业会计准则编制基础下,毛利增长31.5%至13.80亿元。毛利率为40.8%。

3. 在中国企业会计准则编制基础下,毛利增长30.2%至36.66亿元。毛利率为39.5%。

WuXi AppTec Reports Third-Quarter 2019 Results

(SHANGHAI, October 30, 2019) — WuXi AppTec Co., Ltd. (stock code:603259.SH/2359.HK), a company that provides a broad portfolio of R&D and manufacturing services that enable companies in the pharmaceutical, biotech and medical device industries worldwide to advance discoveries and deliver groundbreaking treatments to patients, announces its financial results for the third quarter and nine months ended September 30, 2019 (“Reporting Period”).

This document serves purely as a summary and is not intended to provide a complete representation of the relevant matters. For further information, please refer to the 2019 third quarterly report and relevant announcements published on the websites of the Shanghai Stock Exchange () and the Stock Exchange of Hong Kong (), and the designated media for dissemination of the relevant information. Investors are advised to exercise caution and be aware of the investment risks in dealing in the shares of the Company.

All financials disclosed in this press release are prepared based on International Financial Reporting Standards (or “IFRSs”).

The 2019 Third-Quarter Report of the Company has not been audited.

Third-Quarter 2019 Financial Highlights

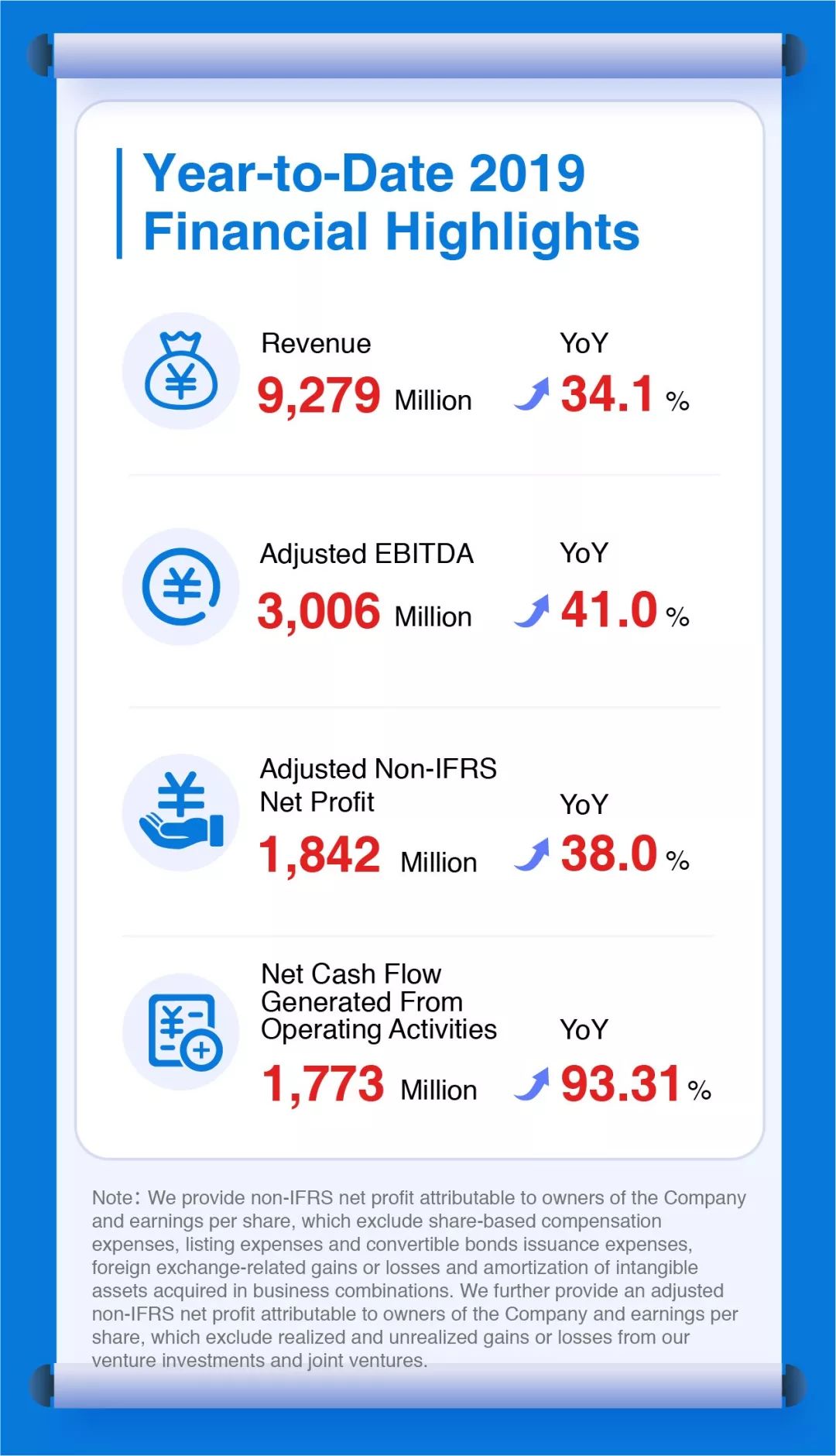

Year-to-Date 2019 Financial Highlights

Management Comment

Mr. Edward Hu, Co-CEO of WuXi AppTec, said, “Our growth continued to accelerate for the third quarter of 2019.In addition, we continue to focus on customer development and business conversion with a strategy of following the projects and following the molecules, leveraging synergies across all our business segments. For the nine months ended September 30, we have gained over 900 new customers and our number of active customers now exceed 3,700.”

Mr. Edward Hu further commented, “During the Reporting Period, our success-based drug discovery unit filed INDs for 16 new-chemical-entities for domestic customers with the China National Medical Products Administration and obtained 20 CTAs.As of September 30, 2019, we have cumulatively submitted 71 new-chemical-entity IND filings with the NMPA for our customers and obtained 54 CTAs. As of September 30, 2019, our small molecule CDMO/CMO pipeline has grown to more than 900 active projects, including 40 projects in Phase III clinical trials and 17 in commercial manufacturing, and our cell and gene therapies CDMO business provided services for 33 clinical stage projects, including 24 projects in Phase I and 9 projects in Phase II/III. In September 2019, we also completed the issuance of USD 300 million zero-coupon convertible bonds, providing the Company with a strong balance sheet for investments, business expansion and potential M&A.”

Dr. Ge Li, Chairman and CEO of WuXi AppTec, stated, “Our business model and the platform we have built continue to perform well. We continue to invest in new capabilities and capacities and believe these investments will allow the company to sustain our long term growth.We will continue to focus on enabling global partners and assisting them to bring the best medicines to patients in need, and to realize our vision that ‘every drug can be made and every disease can be treated’.”

About WuXi AppTec

WuXi AppTec provides a broad portfolio of R&D and manufacturing services that enable companies in the pharmaceutical, biotech and medical device industries worldwide to advance discoveries and deliver groundbreaking treatments to patients. As an innovation-driven and customer-focused company, WuXi AppTec helps our partners improve the productivity of advancing healthcare products through cost-effective and efficient solutions. With industry-leading capabilities such as R&D and manufacturing for small molecule drugs, cell and gene therapies, and testing for medical devices, WuXi AppTec’s open-access platform is enabling more than 3,700 collaborators from over 30 countries to improve the health of those in need – and torealize our visionthat “every drug can be made and every disease can be treated.” Please visit:

Forward-Looking Statements

This press release may contain certain “forward-looking statements” which are not historical facts, but instead are predictions about future events based on our beliefs as well as assumptions made by and information currently available to our management。 Although we believe that our predictions are reasonable, future events are inherently uncertain and our forward-looking statements may turn out to be incorrect。 Our forward-looking statements are subject to risks relating to, among other things, the ability of our service offerings to compete effectively, our ability to meet timelines for the expansion of our service offerings, our ability to protect our clients’ intellectual property, and unforeseeable international tension。

Our forward-looking statements in this press release speak only as of the date on which they are made, and we assume no obligation to update any forward-looking statements except as required by applicable law or listing rules。 Accordingly, you are strongly cautioned that reliance on any forward-looking statements involves known and unknown risks and uncertainties。 All forward-looking statements contained herein are qualified by reference to the cautionary statements set forth in this section。

Use of Non-IFRS and Adjusted Non-IFRS Financial Measures

We provide non-IFRS net profit attributable to owners of the Company and earnings per share, which exclude share-based compensation expenses, listing expenses and convertible bonds issuance expenses, foreign exchange-related gains or losses and amortization of intangible assets acquired in business combinations。 We further provide an adjusted non-IFRS net profit attributable to owners of the Company and earnings per share, which exclude realized and unrealized gains or losses from our venture investments and joint ventures。

Neither is required by, or presented in accordance with IFRS。 We believe that the adjusted financial measures used in this press release are useful for understanding and assessing our core business performance and operating trends, and we believe that management and investors may benefit from referring to these adjusted financial measures in assessing our financial performance by eliminating the impact of certain unusual and non-recurring items that we do not consider indicative of the performance of our core business。

However, the presentation of these adjusted non-IFRS financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with IFRS。 You should not view adjusted results on a stand-alone basis or as a substitute for results under IFRS, or as being comparable to results reported or forecasted by other companies。

1. If prepared under Accounting Standard for Business Enterprises of PRC, the gross profit grew 31.5% year-over-year to RMB 1,380 million. Gross profit margin was 40.8%.

2. If prepared under Accounting Standard for Business Enterprises of PRC, the gross profit grew 30.2% year-over-year to RMB 3,666 million. Gross profit margin was 39.5%.

限 时 特 惠: 本站每日持续更新海量各大内部创业教程,一年会员只需98元,全站资源免费下载 点击查看详情

站 长 微 信: lzxmw777