导读

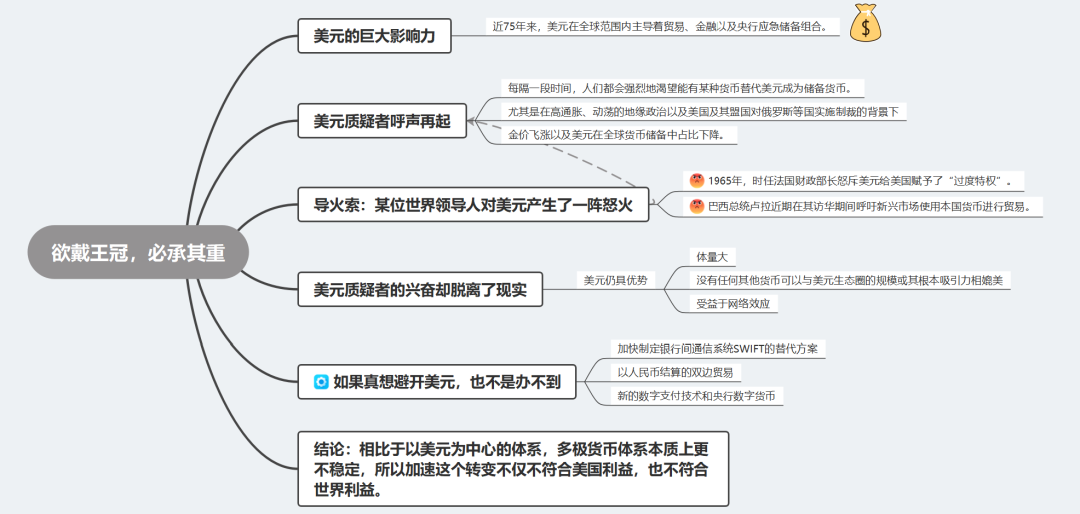

思维导图:

Charlie,往者不谏,来者可追

02新手必读

现在翻译组成员由牛津,耶鲁,LSE,纽卡斯尔,曼大,爱大,圣三一,NUS,墨大,北大,北外,北二外,北语,外交,交大,人大,上外,浙大等70多名因为情怀兴趣爱好集合到一起的译者组成,组内现在有catti一笔20+,博士8人,如果大家有兴趣且符合条件请加入我们,可以参看帖子

五大翻译组成员介绍:

1.关于阅读经济学人()

()

2.为什么希望大家能点下右下角“在看”或者留言?

在看越多,留言越多,证明大家对翻译组的认可,因为我们不收大家任何费用,但是简单的点击一下在看,却能给翻译组成员带来无尽的动力,有了动力才能更好的为大家提供更好的翻译作品,也就能够找到更好的人,这是一个正向的循环。

听力|精读|翻译|词组

Leaders | Heavy lies the crown

社论|欲戴王冠,必承其重

英文部分选自经济学人20230429社论版块

Leaders | Heavy lies the crown

社论 | 欲戴王冠,必承其重

The power and the limits of the American dollar

美元的强大与局限

The greenback is still king. But those who want to evade it are finding ways to do so

美元仍雄踞霸主地位,但部分国家正在寻求“去美元化”方案。

注释:

Heavy lies the crown: Large amounts of power or authority carry with them stress, worry, and self-doubt. Derived from of the line “Uneasy lies the head that wears a crown,” from Shakespeare’s Henry IV, Part II. (Idioms by The Free Dictionary)

Everysooftenan appetite surges for an alternative reserve currency to the dollar—and a market booms in predictions of the greenback’s imminent demise. For nearly three-quarters of a century the dollar has at a global scale dominated trade, finance and the rainy-day reserve portfolios of central banks. Yet high inflation, fractious geopolitics and the sanctions imposed by America and its allies on countries such as Russia have lately caused dollar-doubters to become vocal once again.

每隔一段时间,人们都会强烈地渴望能有某种货币替代美元成为储备货币。每当有人预测美元主导地位即将消亡时,市场就会蓬勃发展。近75年来,美元在全球范围内主导着贸易、金融以及央行应急储备组合。然而,由于高通胀、动荡的地缘政治以及美国及其盟国对俄罗斯等国实施的制裁,美元质疑者呼声再起。

Often these episodes are fuelled by a world leader’s spasm of anger towards the dollar. In 1965 Valéry Giscard d’Estaing, then France’s finance minister, raged against the “exorbitant privilege” the greenback conferred on America. This time it was Luiz Inácio Lula da Silva, Brazil’s president, who on a recent visit to China called for emerging markets to trade using their own currencies. At the same time, a surging gold price and a fall in the dollar’s share of global reserves has roused other doubters, who can also point to this month’s admission byJanet Yellen, America’s treasury secretary, that over time using sanctions “could undermine the hegemony” of the currency. It does not help that America could soon face a fiscal crisis if Congress fails to raise the ceiling that limits how much the government can borrow.

这些情形的导火索往往是某位世界领导人对美元产生了一阵怒火。1965年,时任法国财政部长瓦莱里·吉斯卡尔·德斯坦(Valéry Giscard d’Estaing)怒斥美元给美国赋予了“过度特权”。这一次责备美元的是巴西总统路易斯·伊纳西奥·卢拉·达席尔瓦(Luiz Inácio Lula da Silva),卢拉近期在其访华期间呼吁新兴市场使用本国货币进行贸易。同时,金价飞涨以及美元在全球货币储备中占比下降也引来了更多的美元质疑者,这也印证了美国财政部长珍妮特·耶伦(Janet Yelen)本月的言论——耶伦承认,挥舞制裁大棒,久而久之“可能会破坏美元的霸权地位”。雪上加霜的是,如果美国国会不能提高政府债务上限,美国可能很快面临财政危机。

Yet the doubters’ excitement has become detached from reality. The greenback exerts an almighty gravitational pull on the world economy that has not materially weakened—even if America has recently found that there are real obstacles to exploiting its currency’s pre-eminence.

然而,美元质疑者的兴奋却脱离了现实。尽管美国最近发现在利用美元主导作用为自己谋利时确实阻碍重重,但美元对世界经济的巨大影响力并未实质性削弱。

The starting advantage of the dollar is immense. Between a third and a half of global trade is invoiced in dollars, a share that has been relatively stable over the long term. It is involved in nearly 90% of foreign-exchange transactions; such is the liquidity of the greenback that if you want to swap euros for Swiss francs, it can be cheaper to trade via dollars than to do so directly. About half of cross-border debt is dollar-denominated. And although the dollar’s share of central-bank reserves has fallen over the long term, it still accounts for about 60% of them. There is no sign of a dramatic recent change, save that which has been caused mechanically by central banks revaluing their portfolios to take account of exchange-rate movements and higher interest rates in America.

美元的初始优势是体量大。约三分之一到一半的国际贸易以美元结算,这一比例在很长时间内都保持相对稳定。美元占外汇交易近九成份额,如此高的流动性意味着,如果你想用欧元兑换瑞士法郎,通过美元交易比直接互换更划算。全球约一半的跨境债务以美元计价。尽管长期来看,美元在央行货币储备中的占比有所下降,但仍占六成左右。除了各大央行由于汇率浮动和美国利率高企而纷纷重新评估投资组合所导致的变化,近期并无重大转变迹象。

No other currency is close to matching this ecosystem’s size, or its fundamental appeal: the supply of safe assets available to dollar investors. The euro zone is fragile and its sovereign-debt market is mostly fragmented between its member states. China cannot possibly satisfy global demand for safe assets so long as it both tightly controls flows of capital and runs current-account surpluses (meaning it is, on net, accumulating financial claims on the rest of the world rather than vice versa). And the dollar, as the dominant currency, benefits from network effects. People want to use the currency everyone else is using.

没有任何其他货币可以与美元生态圈的规模或其根本吸引力相媲美:为美元投资者提供安全资产。欧元区孱弱,各成员国的主权债务市场互相割裂。中国如果既严格控制资本流动,又继续保持经常账户盈余(意味着中国依然是对外净债权国而非净负债国),就不可能满足全球对安全资产的需求。同时,作为主导货币的美元还受益于网络效应,人们都想使用别人也在使用的货币。

注释:

the termnetwork effectrefers to any situation in which the value of a product, service, or platform depends on the number of buyers, sellers, or users who leverage it. Typically, the greater the number of buyers, sellers, or users, the greater the network effect—and the greater the value created by the offering.

source: Harvard Business School Online (website)

What is increasingly clear, though, is that individual countries can circumvent the dominant system if they really want to. ThoughRussia’s war economyhas been wounded by sanctions, it has not been crippled, in part because 16% of its exports are now paid for in yuan, up from almost none before it invaded Ukraine.

不过,现在越来越明确的是,如果个别国家真想绕过这一套美元主导体系,也不是办不到。尽管俄罗斯的战时经济因为制裁而受创,但并不至于元气大伤。部分原因在于,目前俄罗斯16%的出口贸易用人民币结算,而在俄乌冲突爆发之前这一比例基本为零。

China’s alternative to theswiftinterbank-messaging systemhas been growing rapidly. It has also been switching more of its bilateral trade towards settlement in renminbi—an easier task than replacing the dollar in trade flows between other countries. Even many firms in the West now use renminbi for trade with China. New digital-payments technologies and central-bank digital currencies could yet make it easier to move money around the world without involving America.

中国正加快制定银行间通信系统SWIFT的替代方案。同时,中国一直在推动更多以人民币结算的双边贸易——这比在其他国家之间的贸易流动中取代美元要容易得多。甚至有很多西方国家的公司现在都用人民币跟中国开展贸易。新的数字支付技术和央行数字货币也可能会让资金在全球范围内流动得更迅捷,并且不用与美国挂钩。

注释:

swift interbank-messaging system:SWIFT的全称是环球同业银行金融电讯协会(Society of Worldwide Interbank Financial Telecommunications),成立于1973年,是一家国际组织,拥有来自世界各地的25位董事会成员。SWIFT是全球银行间最常用的金融信息交换系统,囊括了1.1万家金融机构,几乎遍布全球所有国家。但SWIFT系统只负责金融信息交换,不负责交易,需要与支付清算系统配合进行使用。(来源:天风证券研究报告《铁幕重现?七问七答金融制裁》)

Balance of power

势力均衡

Moreover, Ms Yellen is right that using the dollar to push countries around is no way to make or keep friends. America has not placed secondary sanctions on countries like India which still trade with Russia, because it fears the backlash that would result. Although a shift to a multipolar system of currencies is not imminent, it could occur later this century as America’s share of the world economy shrinks. Such a system would be inherently less stable than one centred on the dollar—so it would be in the interests of neither America nor the world to hasten the shift.

此外,耶伦女士说得没错,利用美元来摆布他国绝不是交朋友或维持友谊的方法。尽管印度等国还同俄罗斯有贸易往来,但由于美国担心引发强烈抵制,所以并没有对这些国家实施二级制裁。世界货币体系朝多极化发展并非迫在眉睫,但随着美国在世界经济中所占份额的萎缩,这种转变有可能在本世纪后期发生。相比于以美元为中心的体系,多极货币体系本质上更不稳定,所以加速这个转变不仅不符合美国利益,也不符合世界利益。

注释:

二级制裁 (Secondary Sanctions):二级制裁的施加对象是不存在美国管辖连接点的第三国主体。二级制裁的基础是一级制裁。美国在部分针对国家(如伊朗、朝鲜等)的一级制裁项目中设立了二级制裁,以扩大一级制裁的影响力。与被制裁对象进行经贸往来的第三国或第三国的公司或国民,将面临二级制裁的风险。美国行政部门对是否实施二级制裁存在较大自由裁量权。触犯二级制裁的,将面临禁止与美国进出口、切断与美国金融系统通道等一系列商业贸易的限制。(来源:兴业银行上海分行微信公众号文章《制裁合规知识“微课堂”之一级制裁与二级制裁篇》)

翻译组:

Yve,我的肩上是风

Alison,“贪玩又自由的风筝”

Leon,男,驻外民工,经济学人读者

校核组:

UU,日日行,不怕千万里

YY,愿逆风如解意,容易莫摧残

Yuqing,女,理想主义体验派,经济学人读者

限 时 特 惠: 本站每日持续更新海量各大内部创业教程,一年会员只需98元,全站资源免费下载 点击查看详情

站 长 微 信: lzxmw777